GoldMining Extends Mineralization At Its La Garrucha Target, La Mina Project, Colombia: Drill Results Include 431.23 M At 0.73 g/t AuEq

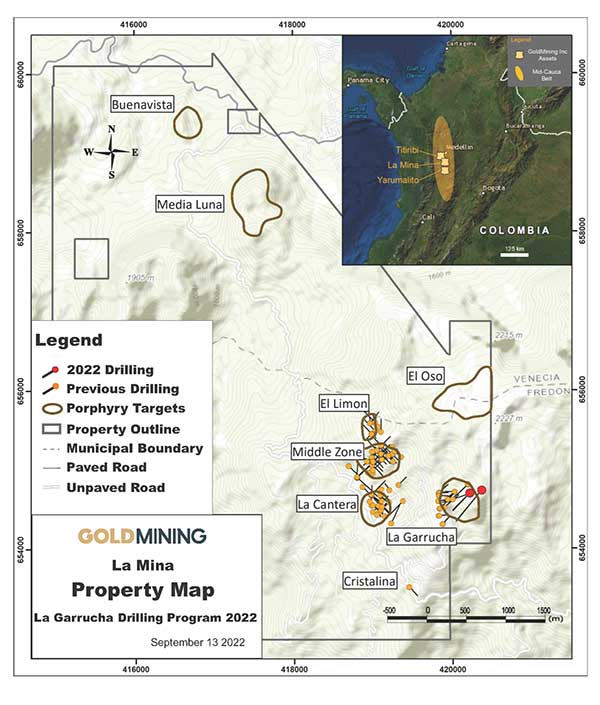

Vancouver, British Columbia – September 13, 2022 – GoldMining Inc. (the "Company" or "GoldMining") (TSX: GOLD; NYSE American: GLDG) is pleased to announce additional assay results from its recently completed five hole 3,485 metre (m) drilling program on the La Garrucha target, located less than one kilometre to the east of existing mineral resources on the Company’s 100% owned La Mina Project (“La Mina”), located in the Middle Cauca Porphyry Belt, Antioquia, Colombia.

Highlights

- The 2022 drilling program has discovered extensions of previously identified gold-copper porphyry mineralization at the La Garrucha target, which is within the La Mina Project.

- Assay results returned to date from the 2022 drilling program have almost doubled the size of the La Garrucha gold-copper porphyry mineral system to at least 400 m strike and 775 m below surface, with the system remaining open to the southeast and to depth.

- LME1108 includes a ‘Main Zone’ intercept of:

431.23 m at 0.55 grams per tonne (g/t) gold (Au) and 0.12 percent (%) copper (Cu), or alternatively expressed as 0.73 g/t gold equivalent (AuEq), from 181.27 m downhole. - La Garrucha lies approximately one kilometre east of existing estimated mineral resources within the La Cantera and Middle Zone deposits.

- Pending receipt of all drill assays the La Garrucha gold-copper porphyry mineral system will undergo geological modelling and will be included in an updated mineral resource estimate for the La Mina Project expected to be initiated in the fourth quarter of 2022, with the intention to initiate an updated La Mina Preliminary Economic Assessment (“PEA”) in 2023.

Alastair Still, CEO of GoldMining, commented, “Our team has completed our first exploration drilling program in Colombia safely and on budget, and we are very pleased with the initial drill results to date, targeting the expansion of the La Garrucha discovery at the La Mina Project. Results from LME1108 will help define the size of the mineralized system, which extends for hundreds of metres and remains open for further expansion. While we still have assay results pending from the final hole drilled in the program, we currently plan to initiate an update to the mineral resource estimate in the fourth quarter of 2022, consistent with our focused approach to unlocking value from our portfolio of gold and gold-copper projects located throughout the Americas.”

Tim Smith, VP Exploration of GoldMining, commented, “The re-entry of LME1108 has extended gold-copper porphyry mineralization over 300 metres deeper than all previous drilling completed at La Garrucha and represents the deepest drilling completed thus far for the entire La Mina Project. This continuity of mineralization to depth provides a new vector for the ongoing exploration of the broader La Mina mineral system. We expect that the synthesis of geological, geochemical and geophysical data amassed from the historic and recent drilling will allow the GoldMining team to identify and prioritize additional targets for future exploration campaigns.”

Drill Program Details and Geological Description

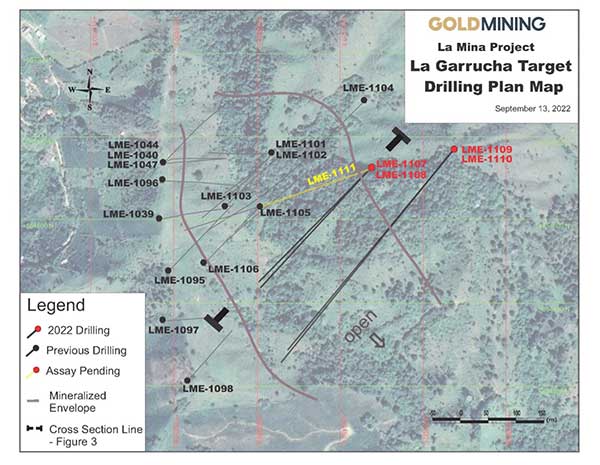

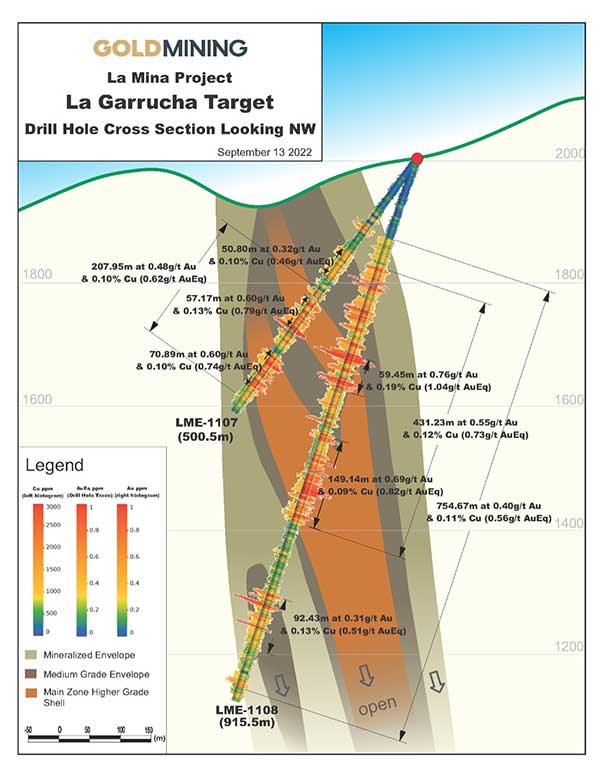

From late March through to mid-August 2022 GoldMining completed a diamond core drilling program, comprising five drill holes for 3,485 m at its La Garrucha target within the La Mina Project (see Figures 1 & 2). On June 23, 2022, the Company announced interim results from the first two holes of the drilling program, including the initial entry of LME1108 which returned 345.54 m at 0.57 g/t Au and 0.12% Cu (0.74 g/t AuEq), from 254.95 m depth. As of the previous reporting date, LME1108 ended in mineralization and up-hole assays had not yet been returned. The Company has subsequently completed a re-entry extension of LME1108 to a total depth of 915.49 m and is now pleased to present comprehensive results for LME1108 which extends mineralization up-hole via additional assay results received, and from the deeper down-hole extension via re-entry drilling.

LME1108 Total Mineralized Porphyry Envelope (extended up- and down-hole via additional core sampling and drill hole re-entry respectively):

754.67 m at 0.40 g/t Au and 0.11% Cu (0.56 g/t AuEq) from 136.20 m downhole

Including ‘Main Zone’ (Medium Grade):

431.23 m at 0.55 g/t Au and 0.12% Cu (0.73 g/t AuEq) from 181.27 m downhole

And Including 'Higher Grade Zones':

59.45 m at 0.76 g/t Au and 0.19% Cu (1.04 g/t AuEq) from 328.92m downhole

(previously reported intercept)

And 149.14 m at 0.69 g/t Au and 0.09% Cu (0.82 g/t AuEq) from 463.36 m downhole

(expanded from previously reported intercept)

And Including a new 'Deep Footwall Zone'

92.43 m at 0.31 g/t Au and 0.13% Cu (0.51 g/t AuEq) from 733.47 m downhole

In addition to re-entry of LME1108, a new fence of drilling located a further 100 metres along strike targeted the edge of the magnetic high associated with the La Garrucha target to test the extents of porphyry mineralization. Drill holes LME1109 and LME1110 intersected broad low-grade porphyry mineralization and both holes ended in low-grade mineralization. Although the underlying magnetic ‘high’ is waning to the southeast, the edges of the host porphyry intrusion have not yet been defined and therefore the mineral system remains open along strike to the southeast. The drill logs and multi-element assay results will be analyzed against a three-dimensional inversion model of the magnetic response to determine whether the system could be extended further to the southeast by drilling.

Comprehensive assay intercepts for LME1107 and LME1108, and partial assay results from holes LME1109 and LME1110, can be found in Table 1.

The 2022 La Garrucha drilling targeted strike and depth extensions of the previously intersected gold-copper mineralized porphyry intrusive system, last drilled in 2011 by Bellhaven Copper & Gold Inc. ("Bellhaven") prior to its acquisition by GoldMining. Selected intercepts from the previous drilling are listed below and a comprehensive summary of historic La Garrucha intercepts is also provided in Table 1.

LME1100 216.80 m at 1.31 g/t Au and 0.15% Cu from 143.0 to 359.80 m downhole

LME1102 158.12 m at 1.01 g/t Au and 0.17% Cu from 66.50 to 224.62 m downhole

LME1104 71.0 m at 1.02 g/t Au and 0.14% Cu from 355.0 to 426.0 m downhole, and

106.60 m at 0.56 g/t Au and 0.11% Cu from 485.65 to 592.25 m downhole

A fifth and final drill hole of the 2022 program, LME1111, was drilled to provide improved confidence of the continuity of the porphyry mineral system between the previous Bellhaven drilling and the recently completed GoldMining drilling (see Figure 2). Core logging and sampling of LME1111 is currently being completed, with assays to be reported as they become available.

La Garrucha gold and copper mineralization is coincident with potassic alteration in the core of the porphyry intrusive complex. Potassic alteration is characterized by secondary potassium feldspar and biotite, disseminated and vein magnetite, quartz stockwork veining and both vein-hosted and disseminated sulphides that include pyrite, chalcopyrite and lesser bornite.

With the 2022 step out drilling the La Garrucha porphyry mineral system now extends over 400 m strike and 300 m width. To depth, the re-entry extension of LME1008 has extended mineralization from a previously intersected maximum depth of 450 m below surface, to approximately 775 m below surface where the porphyry mineral system remains open to depth (see Figure 3).

Geological interpretation of the La Garrucha drilling program will extend to encompass re-logging of the previous Bellhaven core, to place copper and gold mineralization in spatial and temporal context with the hosting La Garrucha porphyry intrusive complex and also to compare against the other La Mina porphyry deposits at La Cantera and Middle Zone. Geological three-dimensional modelling and subsequent geostatistical modelling will be completed during Q4 2022 with the intention to initiate an updated mineral resource estimate by year-end including the La Garrucha mineralization, with current plans to update the La Mina PEA in 2023.

Additional information regarding the La Mina Project, including existing resource estimates and historic work at the project, is set out in the technical report titled "NI 43-101 Technical Report and Preliminary Economic Assessment, La Mina Project, Antioquia, Republic of Colombia" with an effective date of January 12, 2022 (the "Existing La Mina Technical Report"), which is available on the Company's website at www.goldmining.com.

Figure 1 – La Mina Property, deposits and exploration targets, Antioquia, Colombia.

Figure 2 – La Garrucha drill hole locations, La Mina Project, Antioquia, Colombia.

Figure 3 – La Garrucha drill hole Section 1, facing northwest (see section trace on Figure 2).

Table 1 – La Garrucha gold assay intercepts from 2022 drilling program received as of 13th September 2022 and drill intercepts for historic Bellhaven drilling.

| Hole Number | Interval From (m) |

Interval To (m) |

Core Length (m) |

Gold Grade (g/t) |

Copper Grade (%) |

Au Eq (g/t) |

| LME1107 | 186.05 | 236.85 | 50.80 | 0.32 | 0.10 | 0.46 |

| And | 261.60 | 473.45 | 207.95 | 0.48 | 0.10 | 0.62 |

| Including | 282.75 | 339.92 | 57.17 | 0.60 | 0.13 | 0.79 |

| Including | 387.21 | 458.10 | 70.89 | 0.60 | 0.10 | 0.74 |

| LME1108 | 136.20 | 890.87 | 754.67 | 0.40 | 0.11 | 0.56 |

| Including | 181.27 | 612.50 | 431.23 | 0.55 | 0.12 | 0.73 |

| Including | 328.92 | 388.37 | 59.45 | 0.76 | 0.19 | 1.04 |

| Including | 463.36 | 612.50 | 149.14 | 0.69 | 0.09 | 0.82 |

| Including | 733.47 | 825.90 | 92.43 | 0.31 | 0.13 | 0.51 |

| LME1109 | 473.49 | 813.2 | 339.71 | 0.16 | 0.03 | 0.21 |

| Including | 473.49 | 491.93 | 18.44 | 0.34 | 0.06 | 0.42 |

| Including | 526.35 | 551.00 | 24.65 | 0.23 | 0.04 | 0.29 |

| Including | 572.35 | 602.00 | 29.65 | 0.22 | 0.06 | 0.31 |

| Including | 614.32 | 625.40 | 11.08 | 0.26 | 0.05 | 0.33 |

| Including* | 727.55 | 813.20 | 85.65 | 0.17 | 0.02 | 0.20 |

| LME1110 | 368.05 | 663.22 | 295.17 | 0.13 | 0.05 | 0.20 |

| Including | 368.05 | 387.95 | 19.90 | 0.21 | 0.09 | 0.34 |

| Including | 557.19 | 621.11 | 63.92 | 0.21 | 0.06 | 0.29 |

| Including* | 642.93 | 663.22 | 20.29 | 0.18 | 0.07 | 0.28 |

| Historic (Bellhaven) Drill Intercepts: | ||||||

| LME‐1037 | 359.00 | 374.10 | 15.10 | 0.49 | 0.08 | 0.62 |

| LME‐1039 | No Significant Results | |||||

| LME‐1040 | 161.00 | 169.00 | 8.00 | 0.30 | 0.18 | 0.60 |

| And | 192.00 | 210.50 | 18.50 | 0.35 | 0.17 | 0.64 |

| And* | 258.00 | 355.09 | 97.09 | 0.35 | 0.14 | 0.60 |

| LME‐1042 | No Significant Results | |||||

| LME‐1044 | 269.10 | 281.94 | 12.84 | 12.84 | 0.09 | 0.99 |

| LME‐1047 | 119.50 | 129.54 | 10.04 | 0.55 | 0.31 | 1.08 |

| And | 154.00 | 172.40 | 18.40 | 0.31 | 0.15 | 0.57 |

| And* | 178.25 | 242.31 | 64.06 | 0.55 | 0.15 | 0.80 |

| LME‐1095* | 248.20 | 280.11 | 31.91 | 0.47 | 0.09 | 0.81 |

| LME‐1096 | 199.64 | 282.00 | 82.36 | 0.48 | 0.17 | 0.76 |

| And* | 322.96 | 349.81 | 26.85 | 0.64 | 0.13 | 0.85 |

| LME‐1097 | No Significant Results | |||||

| LME‐1098 | No Significant Results | |||||

| LME‐1100 | 99.06 | 107.28 | 8.22 | 0.51 | 0.08 | 0.62 |

| And | 143.00 | 359.80 | 216.80 | 1.31 | 0.15 | 1.55 |

| And | 379.00 | 397.76 | 18.76 | 0.59 | 0.09 | 0.74 |

| LME‐1101 | 94.87 | 174.95 | 80.08 | 0.49 | 0.06 | 0.57 |

| And | 216.71 | 253.59 | 36.88 | 0.45 | 0.03 | 0.49 |

| And | 278.58 | 374.50 | 95.92 | 0.50 | 0.13 | 0.73 |

| LME‐1102 | 7.62 | 13.71 | 6.09 | 0.71 | 0.03 | 0.76 |

| And | 19.81 | 25.90 | 6.09 | 0.53 | 0.03 | 0.57 |

| And | 52.30 | 60.40 | 8.10 | 0.40 | 0.26 | 0.80 |

| And | 66.50 | 224.62 | 158.12 | 1.01 | 0.17 | 1.26 |

| And | 242.00 | 278.00 | 36.00 | 0.34 | 0.13 | 0.54 |

| LME‐1103 | 66.00 | 377.00 | 311.00 | 0.84 | 0.10 | 1.00 |

| And | 392.80 | 421.20 | 28.40 | 0.34 | 0.04 | 0.41 |

| And | 436.77 | 458.30 | 21.53 | 0.41 | 0.04 | 0.48 |

| And | 476.09 | 537.80 | 61.70 | 0.56 | 0.04 | 0.62 |

| LME‐1104 | 236.50 | 268.00 | 31.50 | 0.44 | 0.11 | 0.60 |

| And | 355.00 | 426.00 | 71.00 | 1.02 | 0.14 | 1.24 |

| And | 485.65 | 592.25 | 106.60 | 0.56 | 0.11 | 0.72 |

| LME‐1105 | 0.00 | 145.00 | 145.00 | 0.51 | 0.15 | 0.73 |

| And | 168.60 | 200.25 | 31.65 | 0.38 | 0.04 | 0.44 |

| LME‐1106 | 38.10 | 50.29 | 12.19 | 0.43 | 0.07 | 0.54 |

| And | 171.00 | 441.96 | 270.96 | 1.03 | 0.13 | 1.23 |

Notes:

- For historical drilling, since acquiring an option on the property in mid-2010 and until 2016, Bellhaven advanced exploration by conducting detailed mapping and trenching at La Cantera and Middle Zone, mapping and channel sampling at La Garrucha, mapping, rock-chip sampling and trenching throughout the project area, various ground geophysical surveys, and re-logging and re-interpretation of drill core from previous drilling campaigns. Please see Existing La Mina Technical Report for further details.

- AuEq calculated using metal prices of US$1,600/oz gold and US$3.39/lb copper, as per the La Mina PEA (see January 12, 2022 press release and the Existing La Mina Technical Report). Results are presented as core length and assays are uncut as there are no high-grade outliers in the sample population. Results to date are insufficient to determine true width.

- *Hole ended in mineralized porphyry envelope.

Table 2 –La Garrucha drillhole collar location coordinates.

| Hole Number | Easting Metres (UTM Zone 18) |

Northing Metres (UTM Zone 18) |

Elevation (metres above sea level) |

Depth (metres) |

Azimuth (Degrees) |

Dip (Degrees) |

Status |

| LME1107 | 420207.0 | 654691.0 | 1999.5 | 500.49 | 225° | -50° | All assays received |

| LME1108 | 420207.0 | 654691.0 | 1999.5 | 914.70 | 225° | -70° | All assays received |

| LME1109 | 420356.0 | 654723.0 | 2088.0 | 818.12 | 221° | -50° | Partial assays received |

| LME1110 | 420356.0 | 654723.0 | 2088.0 | 620.0 | 221° | -40° | Partial assays received |

| LME1111 | 420207.0 | 654691.0 | 1999.5 | 550.17 | 250° | -45° | Drilling complete; assays pending |

| Historic (Bellhaven) Drill Collars: | |||||||

| LME‐1037 | 419822.2 | 654598.6 | 2008.49 | 380.08 | 090° | ‐70° | Historic |

| LME‐1039 | 419822.4 | 654598.5 | 2008.76 | 509.93 | 360° | ‐90° | Historic |

| LME‐1040 | 419833.2 | 654703.3 | 2013.51 | 355.09 | 090° | ‐70° | Historic |

| LME‐1042 | 419833.3 | 654703.1 | 2013.54 | 391.66 | 360° | ‐90° | Historic |

| LME‐1044 | 419832.6 | 654702.8 | 2013.41 | 502.92 | 045° | ‐70° | Historic |

| LME‐1047 | 419833.7 | 654703.2 | 2011.88 | 242.31 | 090° | ‐60° | Historic |

| LME‐1095 | 419840.8 | 654507.2 | 1994.24 | 280.11 | 045° | ‐51° | Historic |

| LME‐1096 | 419830.1 | 654667.6 | 2007.1 | 349.81 | 90° | -65° | Historic |

| LME-1097 | 419829.9 | 654415.9 | 1981.45 | 360.27 | 090° | ‐70° | Historic |

| LME-1098 | 419873.0 | 654308.1 | 1980.78 | 297.18 | 045° | ‐65° | Historic |

| LME-1100 | 420026.3 | 654714.3 | 1961.06 | 414.52 | 225° | ‐75° | Historic |

| LME-1101 | 420026.6 | 654716.9 | 1961.05 | 422.45 | 270° | ‐76° | Historic |

| LME-1102 | 420026.3 | 654715.7 | 1961.15 | 320.04 | 225° | ‐60° | Historic |

| LME-1103 | 419940.2 | 654620.1 | 1990.95 | 565.4 | 045° | ‐75° | Historic |

| LME-1104 | 420194.5 | 654811.9 | 2004.27 | 614.17 | 225° | ‐55° | Historic |

| LME-1105 | 420004.2 | 654621.4 | 1954.82 | 285,59 | 225° | ‐68° | Historic |

| LME-1106 | 419902.3 | 654519.6 | 1983.19 | 441.96 | 45° | -55° | Historic |

Qualified Person

Paulo Pereira, P. Geo., President of GoldMining, has reviewed and approved the technical information contained in this news release. Mr. Pereira is a Qualified Person as defined in National Instrument 43-101.

Data Verification

For this program of drill core sampling, samples were taken from the NQ/HQ core by sawing the drill core in half, with one-half sent to ALS Colombia LTDA in Medellín for assaying and the other half retained for future reference. Sample lengths downhole range from a minimum of 0.50 m to a maximum of 2.10 m. ALS Colombia LTDA is a certified commercial laboratory located in Medellín, Antioquia, Colombia and is independent of GoldMining. GoldMining has implemented a stringent quality assurance and quality-control (QA/QC) program for the sampling and analysis of drill core which includes insertion of duplicates, mineralized standards and blank samples for each batch of 100 samples. The gold analyses were completed by ALS Au-AA23 method (fire-assay with an atomic absorption finish on 30 grams of material). Repeats were also carried out by fire-assay. Copper analyses were completed by ALS ME-ICP61 method (four acid digest with ICP analysis).

About GoldMining Inc.

GoldMining Inc. is a public mineral exploration company focused on the acquisition and development of gold assets in the Americas. Through its disciplined acquisition strategy, GoldMining now controls a diversified portfolio of resource-stage gold and gold-copper projects in Canada, U.S.A., Brazil, Colombia, and Peru. The Company also owns more than 20 million shares of Gold Royalty Corp. (NYSE American: GROY).

For additional information, please contact:

GoldMining Inc.

Amir Adnani, Chairman

Alastair Still, CEO

Telephone: (855) 630-1001

Email: [email protected]

Forward-looking Statements

This document contains certain ‘forward-looking information’ and ‘forward-looking statements’ within the meaning of applicable Canadian and U.S. securities laws (“forward-looking statements”) that reflect the current views and/or expectations, including statements regarding the ’ future work programs and planned activities and studies at the Company’s La Mina Project and expectations regarding the La Mina Project. Forward-looking statements are based on the then-current expectations, beliefs, assumptions, estimates and forecasts about the business and the markets in which GoldMining operates. Investors are cautioned that all forward-looking statements involve risks and uncertainties, including: delays to plans caused by restrictions and other future impacts of COVID-19 or any other inability of the Company to meet expected timelines for planned project activities; results of exploration programs may not confirm expectations; the inherent risks involved in the exploration and development of mineral properties, fluctuating metal prices, unanticipated costs and expenses, risks related to government and environmental regulation, social, permitting and licensing matters, and uncertainties relating to the availability and costs of financing needed in the future. These risks, as well as others, including those set forth in GoldMiningꞌs Annual Information Form for the year ended November 30, 2021, and other filings with Canadian securities regulators and the U.S. Securities and Exchange Commission (the “SEC”), could cause actual results and events to vary significantly. Accordingly, readers should not place undue reliance on forward-looking statements and information. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward-looking information, will prove to be accurate. The Company does not undertake any obligations to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.

Cautionary Note to US Investors

The disclosure in this news release and referred to herein was prepared in accordance with NI 43-101 which differs significantly from the requirements of the SEC. The terms “proven mineral reserve”, “probable mineral reserve” and “mineral reserves” used in this news release are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards (the “CIM Definition Standards”), which definitions have been adopted by NI 43-101. Accordingly, information contained in this news release providing descriptions of our mineral deposits in accordance with NI 43-101 may not be comparable to similar information made public by other U.S. companies subject to the United States federal securities laws and the rules and regulations thereunder.

Investors are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, “Inferred mineral resources” are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Canadian standards, including the CIM Definition Standards and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the “SEC Modernization Rules”), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to corresponding definitions under the CIM Definition Standards. During the period leading up to the compliance date of the SEC Modernization Rules, information regarding mineral resources or reserves contained or referenced in this news release may not be comparable to similar information made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be “substantially similar” to the CIM Definition Standards, readers are cautioned that there are differences between the SEC Modernization Rules and the CIM Definitions Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.