GoldMining Announces Resource Estimate for the Yarumalito Gold Project in Colombia

May 5, 2020

Highlights:

- Maiden inferred resource estimate for the Yarumalito Project of 1.24 Moz gold grading 0.58 g/t gold and 0.09% copper or 1.5 Moz gold equivalent grading 0.70 g/t gold equivalent (Table 1);

- The estimate furthers GoldMining's unique position of holding one of the largest global resource-stage gold portfolios among mid- and junior-tier mining companies;

- Yarumalito is GoldMining's third acquisition in the Mid Cauca Belt of central Colombia, which also hosts several multi-million ounce gold deposits owned by Zijin Mining, B2Gold and Anglogold Ashanti; and

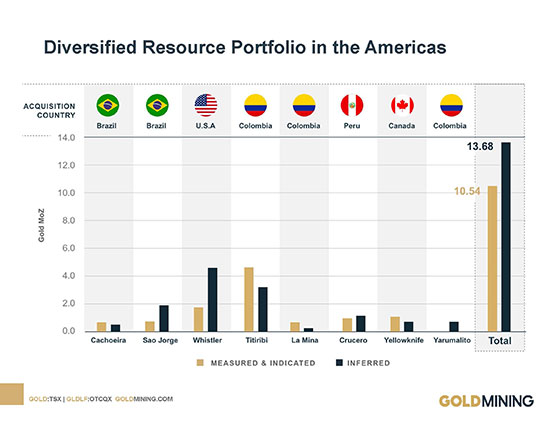

- GoldMining's global aggregated mineral resource (Fig.1 and Table 2) now totals:

- 10.5 Moz gold (13.4 Moz gold equivalent) in the measured and indicated categories; and

- 13.7 Moz gold (16.4 Moz gold equivalent) in the inferred category.

Vancouver, British Columbia – May 5, 2020 – GoldMining Inc. (the "Company" or "GoldMining") (TSX: GOLD; OTCQX: GLDLF) is pleased to announce that it has completed a maiden mineral resource estimate for its 100% owned Yarumalito Gold-Copper Project (the "Yarumalito" or the "Project"), Antioquia, Colombia.

The mineral resource estimate was prepared by Global Mineral Resource Services of Vancouver, Canada and includes a pit constrained inferred resource of 66,271,000 tonnes grading 0.58 g/t gold (1,236,000 ounces) and 0.09% copper (129,262,000 pounds) or 0.70 g/t gold equivalent (1,502,000 ounces) using a 0.5 g/t gold equivalent cut-off. See Table 1 below for information regarding the resource estimate.

Garnet Dawson, CEO of GoldMining, commented, "We are excited to announce this maiden resource for Yarumalito – another strategic acquisition our team identified and executed as part of our long-term plans of focused acquisitions in the Americas. These acquisitions have uniquely positioned us with one of the largest global resource-stage gold portfolios among mid- and junior-tier mining companies. While this has been a cornerstone of our strategy since inception, we see significant value in this position in the current environment of recent gold price improvements and decreasing worldwide gold discoveries.

Yarumalito is located within the same Miocene age gold belt that hosts advance-stage multi-million ounce gold deposits owned by Zijin Mining, B2Gold and Anglogold Ashanti; mineralization hosted on these projects is not necessarily indicative of the future mining potential of the Project. Historic drilling at Yarumalito focused on delineating its gold-copper porphyry potential, however, in addition to intersecting long intervals of gold-copper mineralization, the drilling also intersected numerous high-grade, precious metal-rich base metal epithermal veins such as 33.75 g/t gold over 1.85 m intersected in drill hole YAR-11. Future exploration programs will look to expand and upgrade the gold-copper porphyry mineralization at the Project, which remains open along strike and at depth, and to delineate the high-grade epithermal veins."

The Project

Yarumalito is located approximately 75 km southwest of the city of Medellin in the Department of Antioquia in Central Colombia and approximately 40 km south of GoldMining's La Mina Project. The Project is accessible by paved road with nearby high-capacity power lines, water and labour. Yarumalito is comprised of one concession for a total area of approximately 1,453 Ha.

Exploration programs from 2008 to 2013 outlined several geophysical and geochemical anomalies across the property including the Obispo, La Suiza, Balastreras, Escuela, El Guaico and El Sucre targets. Diamond drill programs (18,540 m in 55 holes) during that period primarily focused on the Balastreras-Escuela mineralization, which has a surface projection of approximately 1,700 m by 400 m and is intersected in drill holes and underground workings to a depth of 600 m.

Resource Estimate

The following table sets forth the mineral resource estimate for Yarumalito.

Table 1: Inferred resource statement1 using a 0.5 g/t gold equivalent cut-off for the Yarumalito Gold-Copper Project, Colombia, Global Mineral Resource Services.

| Mineral Type | Tonnes | Grade | Contained Metal | ||||

| Au | Cu | AuEq | Au | Cu | AuEq | ||

| g/t | % | g/t | Oz | Lbs | Oz | ||

| Oxide | 9,057,000 | 0.54 | 0.09 | 0.66 | 157,000 | 17,283,000 | 192,000 |

| Sulphide | 57,214,000 | 0.59 | 0.09 | 0.71 | 1,085,000 | 111,979,000 | 1,310,000 |

| Total | 66,271,000 | 0.58 | 0.09 | 0.70 | 1,236,000 | 129,262,000 | 1,502,000 |

1Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves. The estimate of mineral resources may be materially affected by environmental permitting, legal, title, taxation, sociopolitical, marketing or other relevant issues.

The Yarumalito deposit was modelled on a series of north-south cross-sections spaced 100 m apart from which a three-dimensional wireframe model was constructed for the mineralized zone at an approximate grade boundary of 0.1 g/t gold. Diamond drill holes (50) totaling approximately 16,635 m were used to define the model. High-grade gold values were capped at 9 g/t gold with 12 assays falling above this value. Assay sample lengths were composited at 5.0 m. Gold, copper and gold equivalent grades were interpolated into the block model in a single pass using inverse distance square weighting. Individual blocks within the model measure 5 x 20 x 25 m in dimension. For a grade to be interpolated into a block it was necessary that a minimum of two and a maximum of four composites be located within the volume of the search ellipse. A maximum of one composite was allowed per drill hole to ensure that each block was informed by a minimum of two drill holes. Average bulk density of 2.3 and 2.7 g/cm3 were used to convert block model volumes to tonnages for oxides and sulphides, respectively. Gold equivalent grades were calculated based on the following formula:

AuEq = ((Au ppm*48.2) + (Cu ppm*0.006))/48.2

where 41.8 equals US$/gram for gold based on a gold price of US$1,500/ounce and 0.006 equals US$/ppm for copper based on a copper price of US$2.70/pound. No allowance was made for metallurgical recoveries.

The block model was validated in three ways: (i) visual comparison of block values with underlying drill hole composite values; (ii) comparison of descriptive statistics for the gold and copper block values with assay and composite values, and (iii) swath plots of gold equivalent composites, gold equivalent block grades and modeled tonnage.

Resources were classified as inferred because the drilling is relatively widely spaced and there has been limited metallurgical testwork. Additional infill drilling and metallurgical test work would be required to confirm grade continuity and metallurgical recoveries, respectively to potentially upgrade the existing resource to indicated or measured categories.

Reasonable prospects for eventual economic extraction were determined by reporting the resource within a conceptual pit shell. The conceptual pit delineated resource is reported within a pit shell using an assumed gold price of US$1,500/oz, copper price of US$2.70/lb, pit slope of 45º, mining cost of US$2.00/t and processing cost of US$8.00/t.

Further details regarding the foregoing estimate, including the estimation methods and procedures, will be available in a Canadian National Instrument 43-101 Technical Report, which will be filed on SEDAR (www.sedar.com) under the Company's profile within 45 days of the date hereof.

Quality Control – Quality Assurance Program

The above resource estimate was based on drilling programs completed by previous operators. The drill programs incorporated control samples including blanks, duplicates and standards as part of their Quality Control – Quality Assurance Program. The control samples from the drill programs have been reviewed and verified by the Qualified Persons (as defined herein) and the assay results were deemed suitable for resource estimation.

Qualified Persons

The resource estimate disclosed herein on Yarumalito was prepared for GoldMining by Greg Z. Mosher, M.Sc., P.Geo., of Global Mineral Resource Services, Vancouver, Canada. Mr. Mosher is recognized as a qualified person as defined in Canadian National Instrument 43-101, is independent of the Company and has reviewed and approved the disclosure regarding the resource estimate herein. Mr. Mosher completed a site visit to Yarumalito on November 14 to 15, 2019.

Paulo Pereira, President of GoldMining Inc. has reviewed and approved the technical information contained in this news release. Mr. Pereira holds a Bachelors degree in Geology from Universidade do Amazonas in Brazil, is a Qualified Person as defined in NI 43-101 and is a member of the Association of Professional Geoscientists of Ontario.

Note on Mineral Resource Estimates

Inferred mineral resources have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under applicable Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies. It cannot be assumed that part or all of an inferred mineral resource will be upgraded to a mineral reserve.

The terms “mineral resource”, “measured mineral resource”, “indicated mineral resource”, “inferred mineral resource” used herein are Canadian mining terms used in accordance with NI 43-101 under the guidelines set out in the Canadian Institute of Mining and Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as may be amended from time to time. These definitions differ from the definitions in the United States Securities & Exchange Commission (“SEC”) Industry Guide 7. As such, information contained herein concerning descriptions of mineralization and resources under Canadian standards may not be comparable to similar information made public by U.S. companies in SEC filings.

About GoldMining Inc.

GoldMining Inc. is a public mineral exploration company focused on the acquisition and development of gold assets in the Americas. Through its disciplined acquisition strategy, GoldMining now controls a diversified portfolio of resource-stage gold and gold-copper projects in Canada, U.S.A., Brazil, Colombia and Peru. Additionally, GoldMining owns a 75% interest in the Rea Uranium Project, located in the Western Athabasca Basin of Alberta, Canada.

Figure 1: GoldMining's Gold Resource Acquisitions in the Americas from 2012 to 2020 (Table 2).

Table 2: GoldMining's Aggregated Mineral Resource Statement across all its Projects1,2,3.

| Deposit | Cut-off4 (g/t) |

Tonnage (Mt) |

Grade | Contained Metal | ||||||

| Gold (g/t) |

Silver (g/t) |

Copper (%) |

Gold Eq (g/t) |

Gold (Moz) |

Silver (Moz) |

Copper (Mlbs) |

Gold Eq (Moz) |

|||

| Measured Resources | ||||||||||

| Titiribi5 | 0.3 | 51.600 | 0.49 | - | 0.17 | 0.78 | 0.820 | - | 195.1 | 1.290 |

| Yellowknife13 | 0.5/1.5 | 1.176 | 2.10 | - | - | 2.10 | 0.080 | - | - | 0.080 |

| Total | 0.900 | - | 195.1 | 1.370 | ||||||

| Indicated Resources | ||||||||||

| Titiribi5 | 0.3 | 234.200 | 0.51 | - | 0.09 | 0.65 | 3.820 | - | 459.3 | 4.930 |

| Sao Jorge6 | 0.3 | 14.420 | 1.54 | - | - | 1.54 | 0.715 | - | - | 0.715 |

| Cachoeira7 | 0.35 | 17.470 | 1.23 | - | - | 1.23 | 0.692 | - | - | 0.692 |

| Whistler8 | 0.3 | 110.280 | 0.50 | 1.76 | 0.14 | 0.79 | 1.765 | 6.130 | 343.1 | 2.797 |

| La Mina9 | 0.25 | 28.170 | 0.74 | 1.77 | 0.24 | 1.12 | 0.667 | 1.607 | 150.2 | 1.013 |

| Crucero12 | 0.4 | 30.653 | 1.00 | - | - | 1.00 | 0.993 | - | - | 0.993 |

| Yellowknife13 | 0.5/1.5 | 12.933 | 2.35 | - | - | 2.35 | 0.979 | - | - | 0.979 |

| Total | 9.630 | 7.737 | 952.7 | 12.059 | ||||||

| Measured and Indicated Resources | ||||||||||

| Total | 10.530 | 7.737 | 1,147.8 | 13.429 | ||||||

| Inferred Resources | ||||||||||

| Titiribi5 | 0.3 | 207.900 | 0.49 | - | 0.02 | 0.51 | 3.260 | - | 77.9 | 3.440 |

| Sao Jorge6 | 0.3 | 28.190 | 1.14 | - | - | 1.14 | 1.035 | - | - | 1.035 |

| Cachoeira7 | 0.35 | 15.667 | 1.07 | - | - | 1.07 | 0.538 | - | - | 0.538 |

| Whistler8 | 0.3/0.6 | 311.260 | 0.47 | 2.26 | 0.11 | 0.68 | 4.626 | 22.617 | 713.5 | 6.731 |

| La Mina9 | 0.25 | 12.394 | 0.65 | 1.75 | 0.27 | 1.07 | 0.260 | 0.697 | 73.3 | 0.427 |

| Boa Vista10 | 0.5 | 8.470 | 1.23 | - | - | 1.23 | 0.336 | - | - | 0.336 |

| Surubim11 | 0.3 | 19.440 | 0.81 | - | - | 0.81 | 0.503 | - | - | 0.503 |

| Crucero12 | 0.4 | 35.779 | 1.00 | - | - | 1.00 | 1.147 | - | - | 1.147 |

| Yellowknife13 | 0.5/1.5 | 9.302 | 2.47 | - | - | - | 0.739 | - | - | 0.739 |

| Yarumalito | 0.5 | 66.271 | 0.58 | - | 0.09 | 0.70 | 1.236 | - | 129.3 | 1.502 |

| Total | 13.680 | 23.311 | 993.9 | 16.398 | ||||||

Table 2 Notes:

- Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves. The estimate of mineral resources may be materially affected by environmental permitting, legal, title, taxation, sociopolitical, marketing or other relevant issues.

- The above aggregated resource table is provided for informational purposes only and is not intended to represent the viability of any project on a standalone or aggregated basis. The exploration and development of each project, project geology and the assumptions and other factors underlying each estimate, are not uniform and will vary from project to project. Please refer to the technical report for each respective project, as referenced herein, for detailed information respecting each individual project.

- All quantities are rounded to the appropriate number of significant figures; consequently, sums may not add up due to rounding.

- Gold cut-off for all projects except for Whistler and Yarumalito, which is gold equivalent cut-off.

- Notes for Titiribi:

- Based on technical report titled "Technical Report on the Titiribi Project Department of Antioquia, Colombia" prepared by Joseph A. Cantor and Robert E. Cameron of Behre Dolbear & Company (USA), Inc., with an effective date of September 14, 2016, which is available at www.sedar.com under GoldMiningꞌs SEDAR profile.

- Gold equivalent estimated for the Titiribi deposit assumes metal prices of US$1,300/oz gold and US$2.90/lb copper and recoveries of 83% for gold and 90% for copper.

- Notes for Sao Jorge:

- Based on technical report titled "Technical Report and Resource Estimate on the São Jorge Gold Project, Pará State, Brazil" prepared by Porfirio Rodriguez and Leonardo de Moraes of Coffey Mining Pty Ltd. ("Coffey"), with an effective date of November 22, 2013, which is available at www.sedar.com under GoldMiningꞌs SEDAR profile.

- Notes for Cachoeira:

- Based on technical report titled "Technical Report and Resource Estimate on the Cachoeira Property, Pará State, Brazil" prepared by Gregory Z. Mosher of Tetratech, Inc. with an effective date of April 17, 2013 and amended and re-stated October 2, 2013, which is available at www.sedar.com under GoldMiningꞌs SEDAR profile.

- Notes for Whistler:

- Based on technical report titled "Technical Report on the Whistler Project" prepared by Gary Giroux of Giroux Consultants Inc., with an effective date of March 24, 2016, which is available at www.sedar.com under GoldMiningꞌs SEDAR profile.

- The Whistler Project is comprised of three deposits: Whistler, Raintree West and Island Mountain.

- Gold equivalent estimated for the Whistler deposit assumes metal prices of US$990/oz gold, US$15.40/oz silver and US$2.91/lb copper and recoveries of 75% for gold and silver and 85% for copper.

- Gold equivalent estimated for the Raintree West deposit assumes metal prices of US$1,250/oz gold, US$16.50/oz silver and US$2.10/lb copper and recoveries of 75% for gold, 85% for copper and 75% for silver.

- Gold equivalent estimated for the Island Mountain deposit assumes metal prices of US$1,250/oz gold, US$16.50/oz silver and US$2.10/lb copper and recoveries of 75% for gold, 85% for copper and 25% for silver (recovered in copper concentrate).

- A gold equivalent cut-off of 0.3 g/t was highlighted in the estimate as a possible open pit cut-off (Whistler, Raintree-shallow and Island Mountain), and a gold equivalent cut-off of 0.6 g/t was highlighted in the estimate as a possible underground cut-off (Raintree-deep).

- Notes for La Mina:

- Based on technical report titled "Technical Report on the La Mina Project" prepared by Scott E. Wilson of Metals Mining Consultants, Inc. ("MMC") with an effective date of October 24, 2016, which is available at www.sedar.com under GoldMiningꞌs SEDAR profile.

- Gold equivalent estimated for the La Mina project assumes metal prices of US$1,275/oz gold, US$17.75/oz for silver and US$2.75/lb for copper and recoveries of 93% for gold and 90% for copper.

- Notes for Boa Vista:

- Based on technical report titled "Technical Report on the Boa Vista Project and Resource Estimate on the VG1 Prospect, Tapajos Area, Para State, Northern Brazil" prepared by Jim Cuttle, Gary Giroux and Michael Schmulian, with an effective date of November 22, 2013, which is available at www.sedar.com under GoldMiningꞌs SEDAR profile.

- Notes for Surubim:

- Based on technical report titled "Technical Report on the Rio Novo Gold Project and Resource Estimate on the Jau Prospect, Tapajos Area, Para State, Northern Brazil" ("Surubim Project") prepared by Jim Cuttle and Gary Giroux, with an effective date of November 22, 2013, which is available at www.sedar.com under GoldMiningꞌs SEDAR profile.

- Notes for Crucero:

- Pit constrained resource estimate based on US$1,500/oz gold, mining cost of US$1.60/t, processing cost of US$16.00/t and pit slope of 47 degrees.

- Based on technical report titled "Technical Report on the Crucero Property, Carabaya Province, Peru" prepared by Greg Z. Mosher with an effective date of December 20, 2017, which is available at www.sedar.com under GoldMining's SEDAR profile.

- Notes for Yellowknife:

- Pit constrained resources with reasonable prospects of eventual economic extraction reported above a 0.50 g/t Au cut-off.

- Pit optimization is based on an assumed gold price of US$1,500/oz, metallurgical recovery of 90%, mining cost of US$2.00/t and processing and G&A cost of US$23.00/t.

- Underground resources with reasonable prospects of eventual economic extraction stated as contained within gold grade shapes above a 1.50 g/t Au cut-off.

- Mineral resource tonnage and grade with reasonable prospects of eventual economic extraction are reported as undiluted and reflect a bench height of 3.0 m.

- Based on a technical report titled "Independent Technical Report for the Yellowknife Gold Project, Northwest Territories, Canada" prepared by Ben Parsons (SRK Consulting (U.S.) Inc.) and Dominic Chartier (SRK Consulting (Canada) Inc. and Eric Olin (SRK Consulting (U.S.) Inc.) with an effective date of March 1, 2019, which is available at www.sedar.com under GoldMining's SEDAR profile.

The above aggregated resource statement is provided for information purposes only. Investors should refer to the underlying technical reports referenced above for project-specific factors relating to each resource estimate.

For additional information, please contact:

GoldMining Inc.

Amir Adnani, Chairman

Garnet Dawson, CEO

Telephone: (855) 630-1001

Email: [email protected]

Forward-looking Statements

This document contains certain forward-looking statements that reflect the current views and/or expectations of GoldMining with respect to its business and future events, including expectations and future plans respecting the Project and any future exploration programs and other work on the Project. Forward-looking statements are based on the then-current expectations, beliefs, assumptions, estimates and forecasts about the business and the markets in which GoldMining operates, including that historical exploration results will be confirmed. Investors are cautioned that all forward-looking statements involve risks and uncertainties, including: the inherent risks involved in the exploration and development of mineral properties, the uncertainties involved in interpreting drill results and other exploration data, the potential for delays in exploration or development activities, the geology, grade and continuity of mineral deposits, the possibility that future exploration, development or mining results will not be consistent with GoldMiningꞌs expectations, accidents, equipment breakdowns, title and permitting matters, labour disputes or other unanticipated difficulties with or interruptions in operations, fluctuating metal prices, unanticipated costs and expenses, and uncertainties relating to the availability and costs of financing needed in the future. These risks, as well as others, including those set forth in GoldMiningꞌs Annual Information Form for the year ended November 30, 2019 and other filings with Canadian securities regulators, could cause actual results and events to vary significantly. Accordingly, readers should not place undue reliance on forward-looking statements and information. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward looking information, will prove to be accurate. GoldMining does not undertake any obligations to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.